In increasingly saturated and competitive markets, retaining existing customers is not only more cost-effective than acquisition but also strategically more sustainable.

However, traditional retention strategies – based on fixed rules, post-drop-off campaigns, or generic offers – prove insufficient in high-intensity digital environments. Today, churn manifests through weak and fragmented signals, such as reduced login frequency, onboarding interruption, or lack of response to key communications.

For this reason, data-driven companies are adopting a new approach based on predictive churn prevention models, capable of:

- Monitoring the customer-brand relationship in real time across the entire lifecycle;

- Assigning a dynamic drop-off risk to each user, based on behavioral, transactional, and contextual data;

- Activating personalized actions before inactivity solidifies, maximizing the effectiveness of loyalty and re-engagement campaigns.

Artificial intelligence, particularly through supervised machine learning models, enables this qualitative leap: it not only identifies at-risk customers but also reveals why they are at risk and which levers (communication, relational, promotional) to activate to recover them, avoiding waste and increasing the average lifetime value of the customer base.

What is AI-Enabled Churn Prevention?

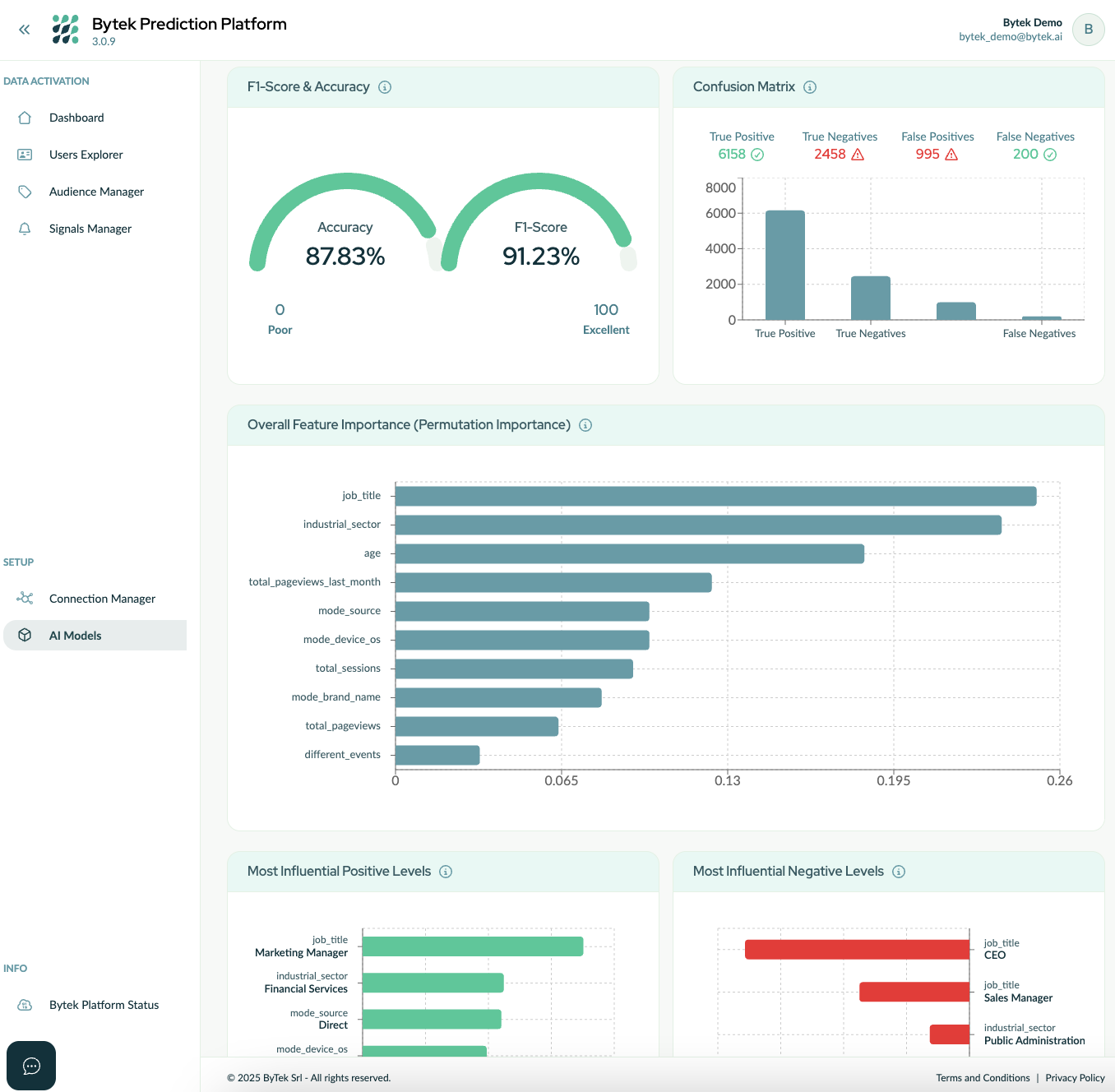

From an operational standpoint, AI-enabled churn prevention relies on supervised models that learn from customer journeys – who churned, when, and under what conditions – to recognize similar patterns among active users. The system combines temporal, behavioral, and contextual variables to generate predictions that can be updated in real time.

The value of AI in this area lies in its ability to manage high-dimensional datasets, integrating heterogeneous inputs: event sequences (navigation logs, purchases, interactions), asynchronous signals (negative feedback, open tickets), transactional data, and lifecycle information. This modeling allows the system to distinguish normal variations from atypical and potentially critical ones.

Unlike rule-based logic, the output is not a simple threshold but a continuously refined and contextualized insight, which can be integrated into company systems to trigger targeted actions such as suppressions, re-engagements, or selective commercial interventions. In this context, AI does not merely predict churn , it enables an evolutionary, data-driven management of the customer base.

The Bytek Approach: Predicting and Orchestrating Retention

In the Bytek Prediction Platform, churn prevention is not based on fixed thresholds or static rules but on an adaptive system built on the proprietary Action Prediction module. This model, typically used to estimate the probability that a user will perform a high-value action (e.g., purchase, demo request, registration), can also be configured to anticipate critical behaviors related to drop-off.

For example, it is possible to model the probability that a user will:

- Make a repeat purchase within a specific time window;

- Complete an onboarding or activation process;

- Respond to a specific nurture or loyalty interaction.

When the propensity scores calculated by the model are significantly low, the platform interprets them as early signals of churn and enables automated corrective actions or flags them for sales/customer care teams. In this way, AI acts not only as a predictive tool but as a proactive engine for orchestrating retention strategies.

The Bytek approach includes:

- Custom predictive models tailored to the business domain (B2C, B2B, subscription, or retail);

- Bidirectional integration with CRM, automation platforms, and media (via reverse ETL or API);

- Continuous updating of predictive scores and transparent model versioning;

- Activation of re-engagement or suppression workflows based on the estimated risk threshold.

This architecture enables interventions before the customer churns, leveraging real behavioral signals and dynamic predictive attributes.